To better assist our clients during this crisis, we have compiled a list of frequently asked questions and answers about how to obtain the information needed for the PPP to help you more quickly find what you need.

To better assist our clients during this crisis, we have compiled a list of frequently asked questions and answers about how to obtain the information needed for the PPP to help you more quickly find what you need.

Q: How do I obtain the payroll report needed for the PPP?

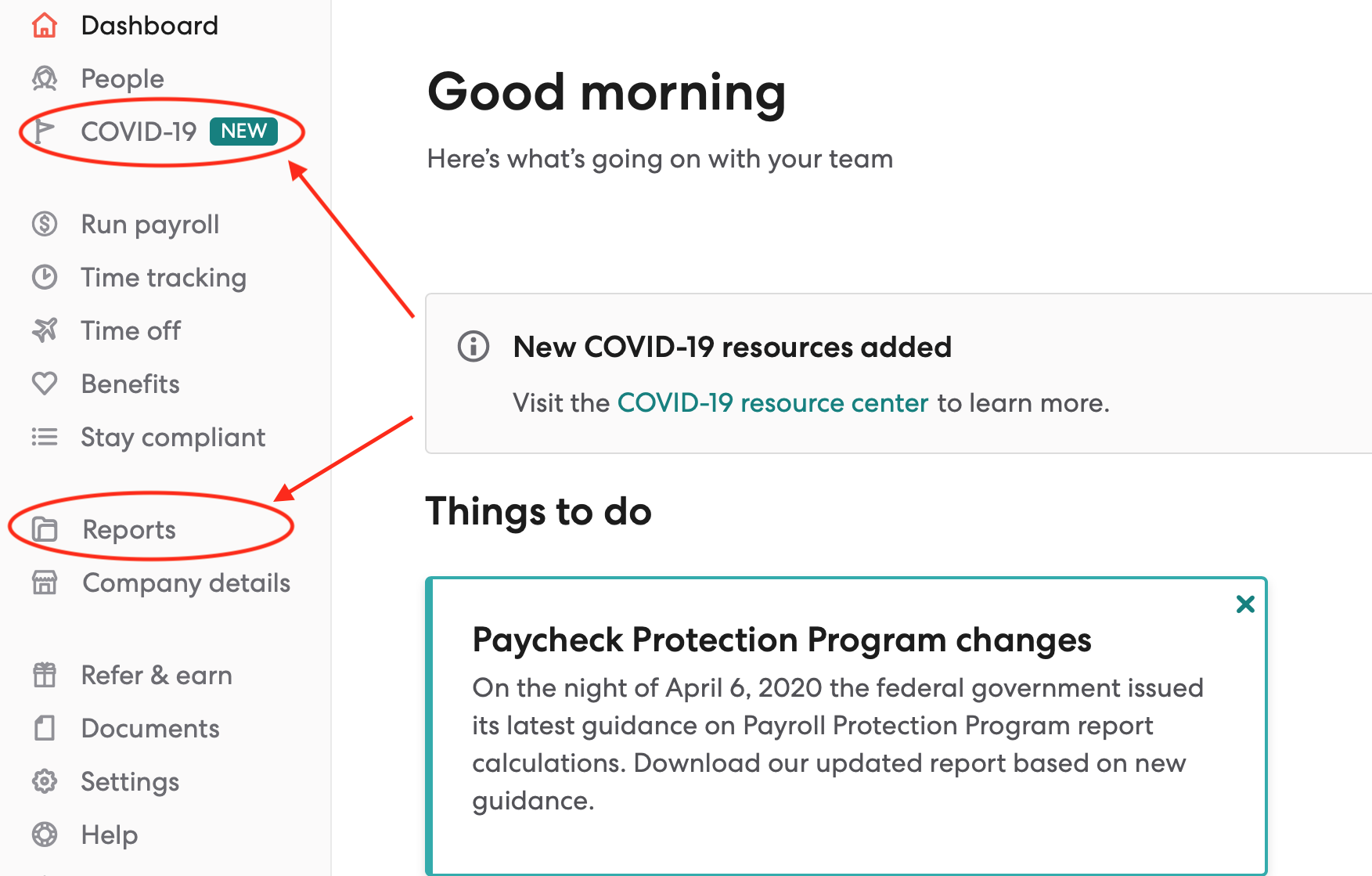

A: Our payroll partner, Gusto, has a special feature to automatically create the required report for the PPP. You can find the report under the COVID tab on the left side when you log in to Gusto or through the Reports tab. Most clients will use the default payroll report from 1-1-2019 to 12-31-2019, however, some that started payroll during 2019 may vary. If you fall into that category, please email us and we will promptly advise and assist.

A: Our payroll partner, Gusto, has a special feature to automatically create the required report for the PPP. You can find the report under the COVID tab on the left side when you log in to Gusto or through the Reports tab. Most clients will use the default payroll report from 1-1-2019 to 12-31-2019, however, some that started payroll during 2019 may vary. If you fall into that category, please email us and we will promptly advise and assist.

If the Reports option is not available, please email us and we will promptly enable those permissions. For the latest information from Gusto, visit the COVID section of their website that is specially created to assist small businesses during this crisis.

Additionally, you may need the report for Q1 of 2020 to verify if you had continuous payroll (i.e. have not laid-off employees). This report is also available in Gusto.

We recommend saving all reports to PDF and then creating a folder named PPP to store all payroll reports for easy upload to your lender.

Q: What other information do banks require to apply for the PPP?

A: Banks vary in the information they require, but often the requirements will be:

- The date you commenced business. You can find this information:

- On the SC Secretary of State website in the Business Search

- On your Articles of Organization or Articles of Existence

- On your business tax return, generally in the upper right-hand corner of page one on the 1120S, 1065, etc.

- Gross revenue from last filed business return, cost of goods sold if applicable

- Business and Primary Officer or Member contact information, household income

- Other officers if there are more than one. For LLC’s, only the primary member is required

Q: Where can I obtain a copy of my business’s quarterly tax documents?

A: In Sharefile, each business client has a folder separated by year and then by quarter. Each quarterly folder contains the 941 (Employer’s Quarterly Tax Return) and the UCE 101/120 Quarterly Wage Report. In addition, the 12/31 folder also contains the 940 (Employer’s Annual Federal Unemployment (FUTA) Tax Return).

You can access Sharefile here, which is also available in the sidebar of our website or in the signature of our email. Your email address is used to log in, and the password is one that you have set in the past. If you have issues with your password, you can use the reset option if needed, and then record your new password somewhere safe.

If you have additional questions regarding the PPP, we ask that you please email us for prompt assistance from our staff. Due to the high volume of calls during this crisis, email allows us to better serve our clients with any PPP needs.